The Situation

As used car prices continue to head down, negative equity is going to be a more common situation for those who purchased a used car in the past couple of years, so pay attention if this is you!

Negative equity is when your car loan amount is more than what your car is worth. It's a situation where you can't just sell or trade the vehicle without having to come up with extra cash to pay off the rest of the loan.

Negative equity doesn't really matter if you keep the car until the loan is paid off (or close to it). It doesn't change anything about the deal you already got. The best thing to do (if possible) is just keep the car until your loan is paid off.

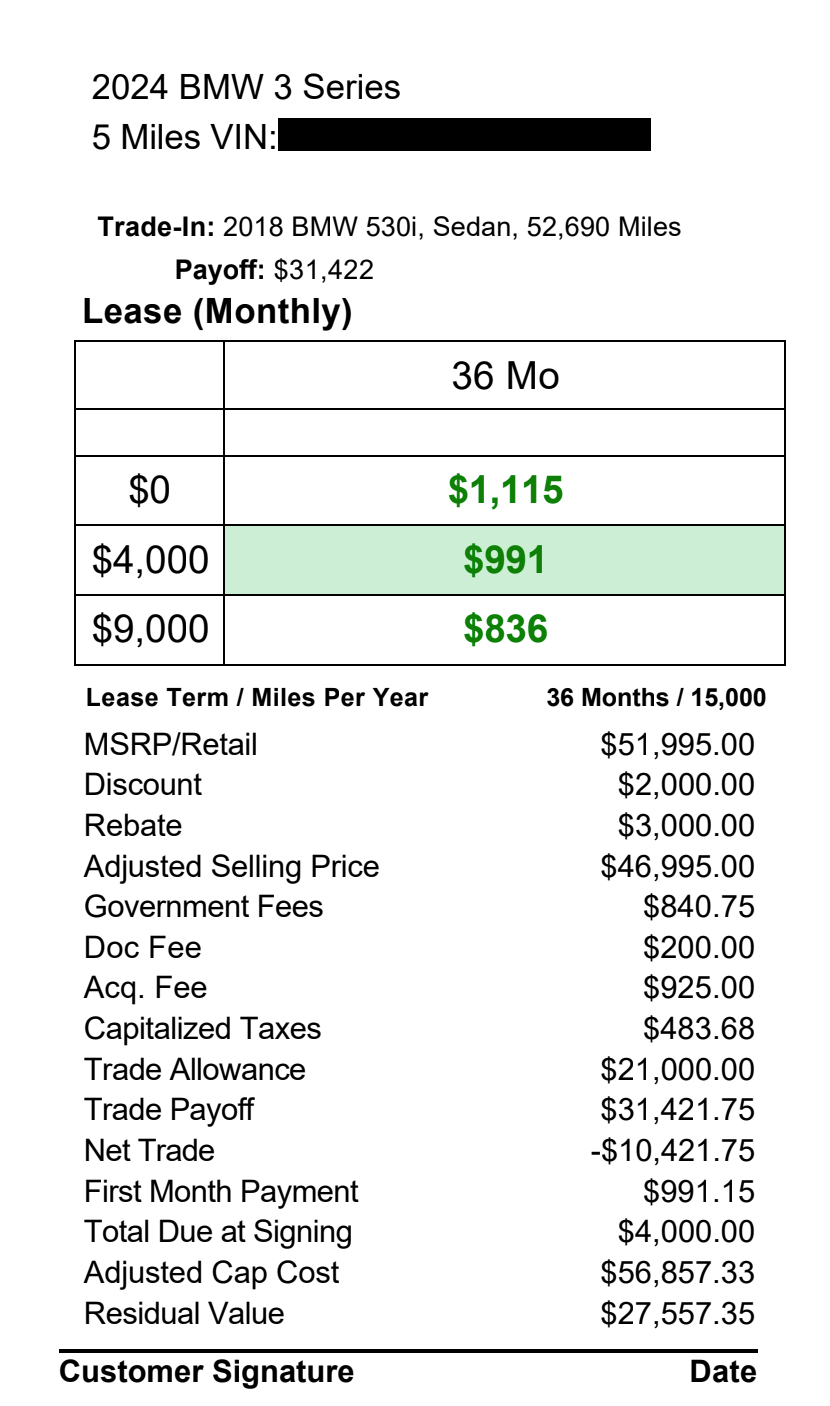

What Dealer Offered

Our reader is trying to trade-in their 2018 BMW 530i AWD with 52K miles. There is $31,421 in outstanding balance on the car loan, but the dealer says it's only worth $21,000 (that's where the $10,000 in negative equity comes from). The dealer generously offers to "give a deal" on a 2024 BMW 3-Series and roll that negative equity into a lease offer. As you can see in the offer below, the monthly payment comes out to $991 with $4,000 due at signing

First, Figure Out "Bang for Buck"

Long-time readers know the way I like to quickly figure out whether a lease deal is good is to figure out the bang for buck and compare it to the table below (Basically anything below 70 is a bad deal and anything above 88 is excellent).

| Percentile | Bang for Buck | Deal Result |

|---|---|---|

| Top 5% | 88 & Above | Excellent |

| Top 10% | 83 - 87 | Great |

| Top 20% | 79 - 82 | Good |

| Top 50% | 70 - 78 | Fair |

| Bottom 50% | Below 70 | Bad |

"Bang for Buck" is simply the MSRP divided by monthly payment, where monthly payment includes down payment and acquisition fee only. It should NOT INCLUDE taxes and government fees (this is so we can do an apples to apples comparison no matter where you live and what your tax rates and fees are).

In order to calculate the monthly payment, I have to figure out the "true" down payment on this offer (because due at signing is not the same thing as down payment). I had to remove the Government fees, doc fees, capitalized taxes, and first-month payment which totals $2,514.83. So the true down payment on this lease offer is $1,485 (including the acquisition fee). I divide that by the term of 36 months, which comes to $41.25, and add that amount to the monthly payment of $991, totalling $1,032.

Now we can get the "Bang for Buck" of this offer: $51,995 divided by $1,032 = 50.38, which of course is a terrible deal. However, we need to subtract $10,0000 to figure out the real Bang for Buck on this lease offer itself without any negative equity. We take $10,000 divided by term of 36, which equals $277.77 and we subtract that from the $1,032 monthly payment to get $754.22.

The "Bang for Buck" on the lease without negative equity = 68.93, considered a bad deal just by itself. But it gets worse...

Did Dealer Lie About Negative Equity?

Rule #1 of smart car buying: NEVER trust what a car salesman tells you without verifying. In this case, the salesman told our reader they had $10,000 in negative equity. This was solely based on the offer the dealer gave the reader for their used BMW - $21,000. But is this what the vehicle is really worth?

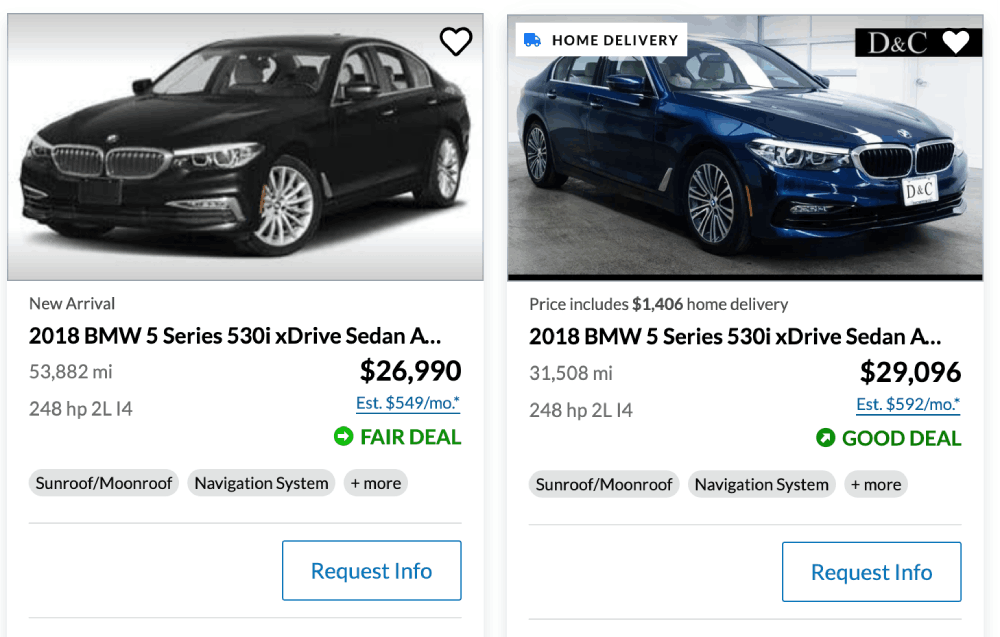

To get an idea of what a vehicle is worth in a private party sale, I like to use CarGurus - I check out the prices of similar vehicles listed in the same region with about the same mileage. Sort by "Best Deals First" and expand search distance to 250 miles to see the prices you're more likely to get if you were to sell the car privately (Deals that are labeled "Fair" or worse are usually priced too high).

Here's what I found for the closest "Best Price" matches...

The "Best Priced" cars were listed for between $26,990 and $29,096. That's $6,000 to $8,000 more than $21,000 the dealer offered. Now, to be fair, a dealer will never offer list price for a used car. The wholesale bid they make is much lower because they need to spend money reconditioning the vehicle and also make a profit. KBB actually lists the trade-in price of the car about what the dealer offered - $21,000, but KBB is wrong much of the time, so I'm wondering if the offer was truly the best they could do (I doubt it).

If you're in a negative equity situation, you need to figure out how to get the most money for your car, and to do that, you definitely don't just want to trade it in.

What The Reader Should Do

My first advice is to seperate out the sale of the BMW first, figure out what it's truly worth on the market. You can start by getting buyout quotes from Carvana and CarMax, the 2 biggest used car superstores. These prices won't be close to the CarGurus list prices, but should be better than the $21,000 you were quoted with the dealer.

If you don't want to go the private-party sale route, you can also shop the vehicle to other BMW dealers and see what the highest trade-in amount they offer. I have a full guide on trading-in your car here.

With these prices in hand, you can list your car as a private party listing and see if you can get a higher price by pricing it between the CarGurus prices of $27,000 and $29,000. This is the most time consuming way, but will get you the most money (thus reducing the negative equity situation).

Next, since you're wanting to switch to a lease, you need to find a vehicle with monthly payments low enough to offset the negative equity and still hit your $600/month budget. (My alternative advice if you want to save the most money over time, is to buy a used vehicle instead of lease, and keep it for at least 5 years.

Assuming you can get $25,500 for the BMW using a private party listing, your negative equity becomes $6,000. Over a 36 month lease term, that equals $166. That means you need to find a vehicle you can lease for $433/month or less.

Looking at my Cheapest Current Lease Deals page, there are over 50 different models you can choose from that have advertised lease deals under $433/month with $0 down. These do not include taxes and fees, so that will be a little extra, but you said you can afford a small down payment so expect a down payment of around $1,500 for any of these vehicles.

So, the main lesson of this situation is to NOT just rely on what a dealer tells you, and always seperate each part of your deal - meaning price out your trade-in seperately, get your own financing quotes, and negotiate new deals seperately. This is all the more important if you have negative equity, because the more you can get for your car, the less negative equity you will have to roll over into your next one.

Each week, I'll keep you up-to-date on the latest car deals and news that might affect your purchase. This includes...

- Best Rebates, Incentives, and Lease Deals

- Latest Car Buying Scams and Tricks

- The Best & Worst Time to Buy a Car

- Which Cars You Should Avoid

Got a Question About This Week's Deal Review?