How to Sell Your Used Car Privately

Almost half of all used cars sold each year are sold to a private party - meaning neighbors, friends, individuals.

There's huge demand for good used cars, so if you have a well maintained, late model vehicle and you're thinking about trading in, you should seriously consider selling it to a private party - you could end up making thousands of dollars more this way vs trading in to a dealer.

Here's how to sell your used car like a pro and get the highest price for it.

How Much is Your Car Worth?

The first thing to do is get a good feel for how much your car is worth. You can start by checking the online pricing guides, but as I've pointed out before, you can't rely on them for anything other than a ball-park value.

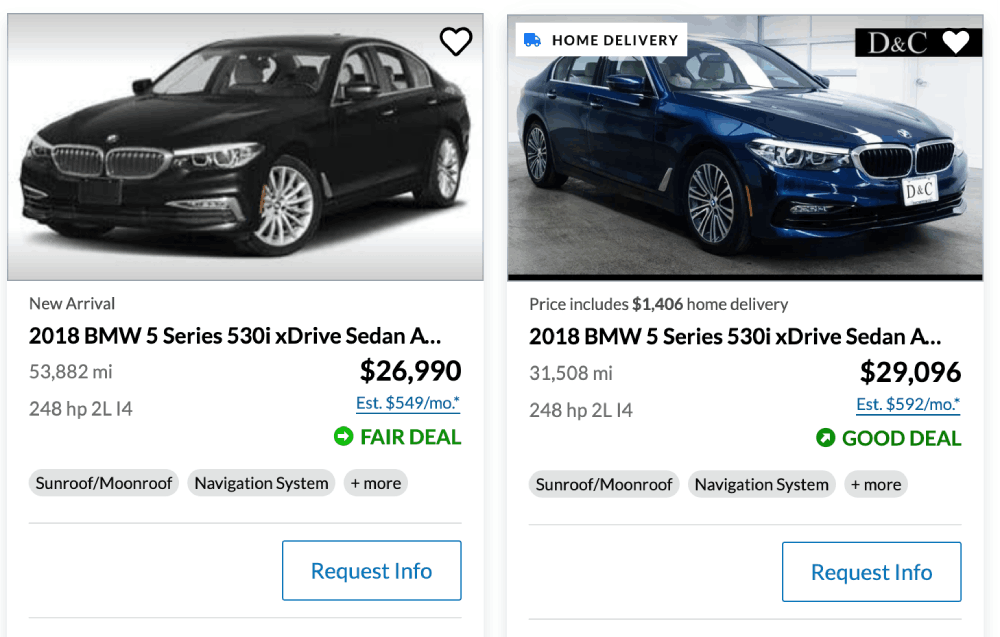

A quick and easy way I like to use to get an idea of what a car is worth is to find the same year, trim, and mileage vehicle on CarGurus, use a search distance of 250 miles, and filter by "Best Deals". CarGurus uses an algorithm that assigns how good of a deal each listing is compared to similar listings. Those labeled "Great" are listings that are typically priced to sell quickly. Those will be the prices you may be able to fetch in a private party sale.

Next, check out similar car listings in your area on other popular listing sites such as Craigslist (click "cars+trucks" under for sale, and filter "by owner"), Cars.com, AutoTrader.com, and FaceBook Marketplace. This should give you a really good idea on what your vehicle may sell for.

If you really want to go the extra mile, you can actually try negotiating with a couple of the more enticing listings and see what they will sell for. Call up the owner and ask them the following questions:

- What condition is the vehicle in?

- What additional options does it include?

- Has it ever been in an accident?

- Has it been smoked in?

- Do you have full maintenance records?

- Are you the original owner?

Next, offer them 20% to 25% below their asking price to see if they're willing to sell at that price. Go back and forth until you get a number they'll agree to, at which point you'll have a realistic number you can compare with.

This gives you a good idea of what your car will sell at retail. The ideal strategy is to price your car somewhere between the private party prices and the retail prices. Check out the section, How to Set the Initial Asking Price for Your Used Car for further tips.

Best Places to List Your Car for Sale

If you do a search for "used car classifieds" on any search engine, you'll get hundreds of sites allowing you to list your car for sale.

Obviously you don't want to spend hours sifting through all that data and figuring out which sites are worthwhile to list on. Luckily, there's only a few that are really important.

Online Automotive Marketplaces

The three largest automotive marketplaces are CarGurus, Cars.com and AutoTrader. Most of their listings are from dealers, but they do allow private party listings (Cars.com is even free to list). They attract millions of visitors per month, so your listing should get lots of visibility.

-

CarGurus is the biggest online marketplace for used cars. I've found they tend to aggregate the most listings, and also show which vehicles list for fair prices.

Most of their listings is from dealers, but they do allow private party listings. You will need to scroll down and click the link that says "or List for $4.95" - it's easy to miss.

-

Cars.com syndicates their listings to over 175 newspapers and partners. They have about 3 million used cars for sale at any given time.

It's free to list your private party ad, just be sure to click the tab that says "List on Cars.com".

-

AutoTrader.com offers a similar package. A $49 listing gets you a listing on both Autotrader and their sister publication Kelly Blue Book.

For Sale By Owner Sites

There are really only 2 "For Sale by Owner" sites you need to list your vehicle on, unless you have a special or collector vehicle, then I've got 2 more recommendations for those.

-

Craigslist is the largest for-sale-by-owner site. The listings here can be very un-organized, but it's definitely worth including your vehicle. Craigslist charges $5 to list a sale-by-owner listing in the cars section - well worth it.

-

Facebook Marketplace has also become a pretty good place to buy and sell used cars from private parties.

If You Have a Classic or Vintage Vehicle

-

Cars & Bids is a great place to list classic or collector cars.

-

Bring a Trailer is another great listing site for collector and vintage vehicles.

By listing your used vehicle on these sites, you should have all your bases covered.

How to Set the Initial Asking Price

If you're going to sell a used vehicle to a private party, you need to figure out how to price it correctly.

If you set an asking price too high, you may not get any responses. On the flip-side, you don't want to short-change yourself by pricing it too low either.

Figure Out Rock Bottom Price First

If you want to do it right, your first step should be to figure out the wholesale value of the vehicle. This is the price dealers are willing to pay for it.

The only way to figure this out is to shop it around to at least 3 dealers using my trade-in shopping guide. Only then will you know the true wholesale value. (Note: don't rely on pricing guides to give you a realistic wholesale price. They're a good starting point, but can be off by up to 15% depending on local market conditions).

Figure that you'll spend around $100 on classified ads and several hours responding to and meeting with prospective buyers, so you'll want at least $1,000 to $1,500 more than wholesale value to compensate you for the added expense and time (really should be aiming for over $2,000).

If you're planning on buying a new car and you live in a state that provides a trade-in tax credit (see list here), you need to factor that in as well. For example, on a used car worth $20,000, the trade-in tax credit can save you up to $2,000 - but this is only available if you trade-in the vehicle at the same dealership where you buy a new one.

Add these figures to the wholesale price to come up with the minimum price you should accept from a private party. For example, if you want $2,000 over wholesale value and there's a trade-in tax credit worth $1,000, you should price it $3,000 above wholesale value. Important: this is not your asking price, but merely the lowest rock-bottom price you're willing to accept in a private party sale.

Figure out the Initial Asking Price

To figure out your asking price, I recommend you check out car listings at CarGurus.com. They calculate the average asking prices for over 3 million vehicles that are currently for sale.

Figure out the average asking price for vehicles that are similar to yours in year, style, and mileage and within 250 miles of where you live. Next, find the highest asking price for a similar vehicle in your region.

Your asking price should be somewhere near the middle between the average and highest listed price. Use some common sense here - if the highest listed price is ridiculously high, use the next highest price, or average the top 3 highest prices to come up with that figure.

This method gives you a simple and quick way to price your vehicle based on real local market conditions. It also sets a minimum price you're willing to accept - ultimately helping you with your negotiations when prospects begin responding to your ad.

How to Place an Effective Classified Ad

If you're trying to sell your vehicle to a private party, the first (and most important) step is to get prospects interested enough to contact you.

This means you need to spend time creating an effective classified ad. It's amazing how lazy some people are when it comes to this.

Most used car classified ads are boring, don't contain enough information, and are missing good photos of the vehicle.

The classified ad is the first impression buyers will have of your vehicle. Present it well, and the car sells itself. There are some great online resources that will show you how to prepare and write your vehicle ad.

First, read AutoTrader's guide to Creating an Effective Car Ad. This will give you a good overview of all the information you should include in your ad.

It's particularly important to take great photos of your vehicle showing multiple angles.

This is especially important when placing Craigslist ads. I recommend including high resolution photos which will differentiate your ad from all the others. Take photos from all angles, and kneel down when taking the photos - get down to the car's level, these photos will look so much better.

You can host your images on a free image hosting service such as ImgUR and embed the images directly into your Craigslist ad.

If it's applicable, the main things you want to emphasize in your ad are:

- Low Miles

- Clean and Well Maintained

- Full Service Records

- Non-Smoking

- One Owner

Don't skimp on the classified ad - it's the most important part of the entire selling process.

Dealing With Buyers

This is the toughest part when it comes to selling your car - dealing with the general public!

There will be shoppers trying to low-ball you, those who don't show up for appointments, and those who have no common sense or manners.

Here are the most common situations you'll encounter and the best ways to respond:

-

If they ask what your rock bottom price is

Just tell them you haven't established one yet. Let them know there are a few people interested and that you're confident you will work out an agreeable price with one of them. Tell them you've done a lot of research and know its a fair price, then counter offer by knocking a couple of hundred off the asking price. -

If they make a low-ball offer right off the bat

This is a strategy many buyers use hoping you'll be desperate and agree to it. Simply counter offer with a price that's a little bit lower than your asking price and remind them of the main benefits of your car (non-smoking, clean, well maintained, etc.) -

If they won't budge on their offer

Try to use the old salesmen's trick by telling them you have someone coming by to take a look at the car in the morning, and that they offered $500 more for it. Let them know if they make an offer you like, you'd rather do the deal today and get it over with. This can work like a charm! -

If they're offended by your lack of haggling

Ask them what they think a fair price would be for the vehicle. If they low ball again, thank them for coming by but that you're sure someone else will pay what the car is worth. -

If they make a counter-offer slightly below your rock-bottom price

Counter offer with your lowest price and tell them that's absolutely the lowest you will go.

Dealers May Contact You - Be Prepared

You may also get calls from dealers wanting to buy your car. They will usually inform you they have a customer looking for your type of vehicle. It's a lie - they're just trying to find used cars to stock for their inventory.

No car dealer will pay you anywhere close to retail price for your vehicle, so it's best to just tell them you're not interested in selling to them.

They may try to entice you by offering your asking price, but the truth is - they just want you to come to the dealership where they will find problems with your car and bid a much lower price hoping you go for it since you're already there.

An exception is if you get a call from Carvana or Carmax. They will provide you with geniune offers.

The truth is - it usually takes at least a week or two to find serious buyers assuming you priced your vehicle fairly. Keep this in mind and be prepared to deal with some disappointments along the way.

You can of course luck out and sell your car right away, but that's more an exception than the rule.

How to Complete Paperwork and Payment

Most private car sales go smoothly. Just use a little common sense, follow my guide, and you should be good to go whether you're a buyer or seller.

The paperwork and payment are easiest when the seller owes no money on the vehicle and already has the title in hand. But even if this is not the case, there are certain precautions you can take which offer protection no matter the situation.

The following guide offers general best practices when buying or selling a used car to a private party. The specific requirements for transferring a title differ slightly from state to state, so always be sure to check with your local DMV for details.

Scenario 1: Seller Has the Title

This is the best case scenario. First, both parties should fill out and sign a Bill of Sale which lists the Vehicle identification number (VIN), agreed purchase price, odometer reading, and name/address of the buyer and seller.

Next, the buyer needs to take care of the payment. The best way is at their bank, in person. The buyer should get a cashier's check made out to the seller for the amount agreed to.

Another option is to use an escrow service. I recommend Escrow.com, which protects both buyer and seller.

Whatever you do, don't agree to wiring money when doing a private party sale - there is simply too much fraudulent activity associated with this.

After the payment has been transferred, the seller needs to sign the title over to the buyer (instructions are normally provided on the back). The seller will then need to contact the DMV within 5 days to transfer ownership and release themselves from any liability for the vehicle.

Again, check with your local DMV as each state has slightly different requirements.

Scenario 2: Seller Does Not Have the Title

If the seller still owes money on the vehicle, then their lender will be in possession of the title. It will only be transferred when the seller has paid off the loan in full.

In this scenario, there are basically two options. The buyer and seller can both go to a local branch of the lender (if it's available). The buyer can pay the lender directly and provide them with their name and address so they can fill out the paperwork and have the title transferred.

The other option is to complete the bill of sale and have it notarized to help protect the buyer against fraud.

The buyer will then make payment either through check or escrow service, and the seller will use that payment to pay off the loan and get the title. In the meantime, the buyer will have to take the bill of sale to the DMV and get a temporary operating permit so they can use the vehicle while waiting for the title.

Once the seller gets the title from the lender (usually in about 10 days), they will then mail it to the buyer and the sale is complete. This option requires a bit of trust by the buyer since they will have to make a payment without a title.

That's why it's important to get the Bill of Sale notarized and why you should consider using an escrow service.

Precautions to Take When Selling Your Car

One major reason more people don't try to sell their cars to a private party is due to the fear of inviting strangers over to check out their vehicle.You hear stories in the news of people getting robbed and having their cars stolen after putting up a classified ad. While these things do happen, they are very unlikely and there are steps you can take to minimize the likelihood of this happening to you.

Use Your Gut Instinct

Your first line of defense is to use your gut instinct when communicating with the prospective buyer, either through email or phone. If something doesn't feel right, trust your instincts - there is no need to continue dealing with that person since there are plenty of other buyers in the market.

Meet in Public Places

If you live in a large apartment complex and the parking lot is outdoors and usually busy, it's usually fine to meet your prospects there. If you live in a single family home, it's best to meet up somewhere nearby such as a busy grocery store parking lot or mall.

Never go to an area you're not comfortable with and don't meet them at a place that they specify. Try to go only during the day, never at dusk or night.

Test Driving

This is a tricky issue. On one hand, you don't want to hand over your keys to a complete stranger and let them drive away in your car alone. On the other hand, you don't necessarily want to get into a car alone with a stranger.

On top of this, you don't know if they're a safe driver. People have been seriously injured or even killed during test drives, especially if your car is a high performance vehicle.

If you're comfortable letting them drive alone (they prefer that anyway), make sure you keep their current car keys and some sort of identification such as a credit card. Also make sure to check their driver's license and write down their license number.

If you would rather ride along on the test drive, you should try to bring someone along, preferably someone much larger than you. Either way, use some common sense and go with your gut.

Each week, I'll keep you up-to-date on the latest car deals and news that might affect your purchase. This includes...

- Best Rebates, Incentives, and Lease Deals

- Latest Car Buying Scams and Tricks

- The Best & Worst Time to Buy a Car

- Which Cars You Should Avoid

About The Author

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Got a Question About This Article?