Used Car Prices Declining

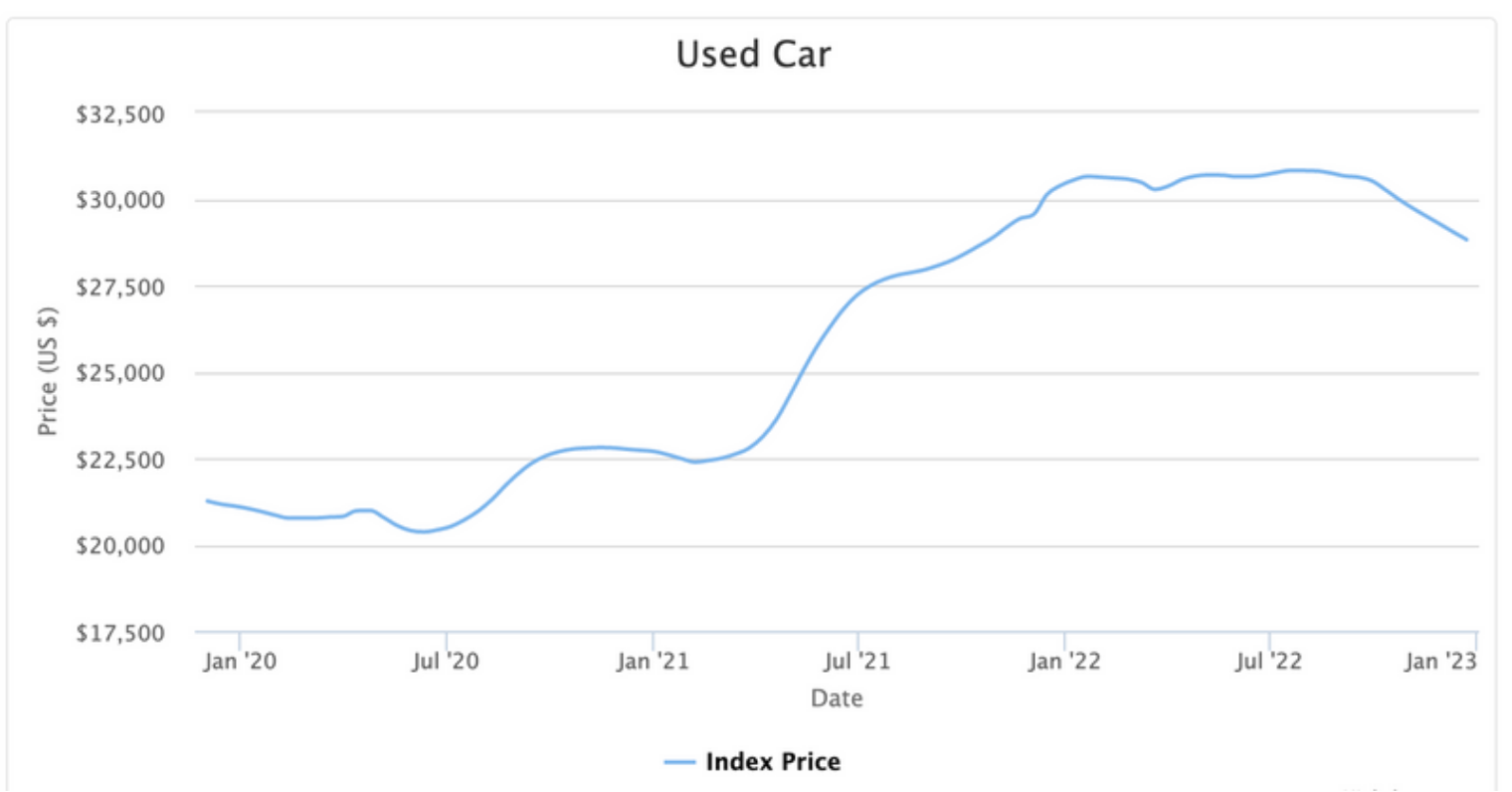

It's finally happening! Used car prices are starting to go down, due in part to an increase in repossessions and rising interest rates. However, they are still way above the historical averages as you can see in the chart below.

According to CarGurus, used cars are currently listed at an average price of $28,800, which is down from $30,600 just 3 months ago. However, the average listing back in July of 2020 was around $21,000, so there's still a long way to go.

Rising Interest Rates

One of the major reasons causing this decline is rising interest rates. As interest rates go up, it becomes more expensive to finance a car purchase. Basically, with average financing rates currently at 6-10% for those with good credit, and much higher for those with poor credit, many can't afford cars at these prices. This is the major cause of the recent price drops so far, but there's more on the horizon...

Increase in Repossessions

Over the past couple of years, car buyers have been taking out loans on overpriced vehicles, and now that car prices are starting to head down, they're "underwater", meaning they owe the lender more than what the car is worth. Some of these buyers can't afford the payments, and will simply default on these loans, but there may actually be a much bigger problem on the horizon, one that may cause a huge wave of repossesions in 2023.

According to a popular Twitter account called CarDealershipGuy, he's seeing a new trend among lenders. They're starting to waive "open auto stipulations" for consumers, meaning they don't care if the consumer already has an outstanding car loan. They know that many car buyers overpaid for their last car, and now that they want to trade it in, they can't afford to since they owe more on the car than what it's worth. By waiving the open auto stipulation, the lender knows the car buyer will default on the other loan, but will likely keep the new one.

It's worth reading the full twitter thread to get a better idea of the situation, and how it will impact used car prices in 2023:

This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending.

— CarDealershipGuy (@GuyDealership) December 16, 2022

I'm now convinced that there is a massive wave of car repossessions coming in 2023.

Here's what I discovered (and what no one knows):

So, When Should You Buy a Used Car?

My advice is to wait several more months if you can - preferably 6 to 9 months. If used car prices continue to drop at the same pace they've been dropping for the past 3 months, we could see another 12% drop in prices by June 2023. On today's $25,000 used vehicle, you should be able to get it for $22,000. That's like saving $500 each month you wait. If the wave of reposessions does start happening in 2023, we should see prices drop even faster!

If you really need the vehicle now, try to pay cash or pay the largest down payment you can afford. With interest rates high, you don't want to take out big loans. Make sure to cast a wide net when you're shopping for a car, and don't be put off by high list prices, many dealers are willing to negotiate now and many are hesitant to reduce list prices, so prices may seem higher than what they really are.

Each week, I'll keep you up-to-date on the latest car deals and news that might affect your purchase. This includes...

- Best Rebates, Incentives, and Lease Deals

- Latest Car Buying Scams and Tricks

- The Best & Worst Time to Buy a Car

- Which Cars You Should Avoid

About The Author

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Latest Weekly Car Buying Tips

January 2026

- Best Car Deals by Category Jan 23, 2026

- Worst Cars to Lease Right Now Jan 23, 2026

- Real Prices of New Compact SUVs Jan 23, 2026

- Cheapest Luxury Lease Deals Jan 23, 2026

- Top 100 Cheapest Lease Deals Jan 15, 2026

- Biggest Discounts on New Cars January 2026 Jan 15, 2026

- New Cars with the Most Available Inventory Jan 15, 2026

- Real Prices of Midsize Cars Jan 15, 2026

- Best 0% Finance Deals January 2026 Jan 09, 2026

- Best Bang for Your Buck Lease Deals Jan 09, 2026

- Best Electric, Hybrid Lease Deals Jan 09, 2026

- Real Prices of Compact Cars Jan 09, 2026

December 2025

- Best End of Year Car Deals for 2025 Dec 25, 2025

- Cars With the Largest Rebates Dec 25, 2025

- Real Prices of Large SUVs Dec 25, 2025

- All SUV Lease Deals Compared December 2025 Dec 18, 2025

- Top 100 Cheapest New Cars Right Now Dec 18, 2025

- Price Comparison of Subcompact SUVs Dec 18, 2025

- Real Prices of Midsize SUVs Dec 11, 2025

- Largest Hidden Dealer Rebates Dec 11, 2025

- Real Prices of Pickup Trucks Dec 04, 2025