Real Finance Rates with 750 Credit Score

Interest rates on auto loans have gotten bad. How bad? If you have excellent credit, you can expect to pay over 6% interest on a 60 month loan. Those with bad credit are paying upwards of 20%!

According to Edmunds, the average interest rate on new vehicles rose to 6.5% in the last 3 months of 2022, compared to 4.1% a year ago. That's more than a 2% increase in just one year, adding about $2,000 in additional cost to the average new car loan.

It looks like rates have risen even more just in the past few weeks. According to Jonathan Dorf, a General Sales Manager at a Honda dealership in Pennsylvania, even those with good credit scores of 750 and higher are getting quotes as high as 7.49%.

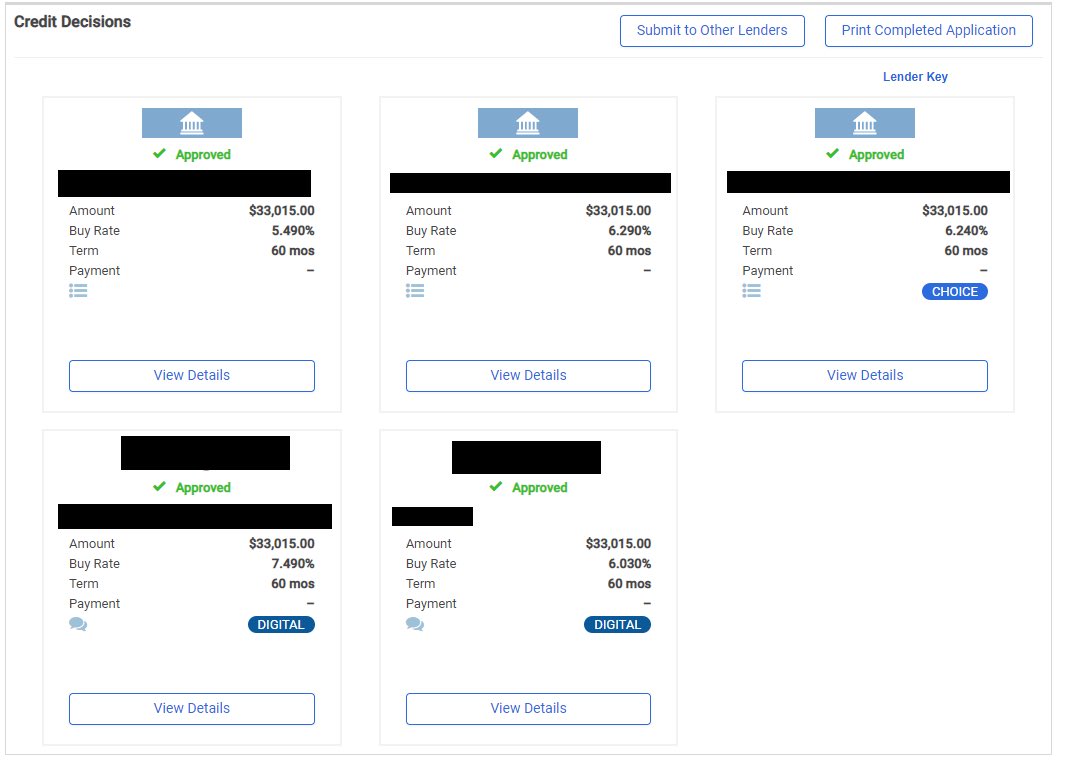

Jonathon shared the following image on a recent twitter post showing the rates he got on a 60 month loan from 3 local credit unions and 2 large lenders.

The interest rates for a $33,000 loan on a 2023 Honda ranged from 5.49% to 7.49%. The average rate was 6.3%, and these do not include any dealer markup, which can add up to 2.5% on top of these rates.

It goes to show how important it is to shop around for the best finance rates. Just with this example, the difference between the lowest and highest quoted rate is $31 per month, which doesn't seem like a lot, but over a 60 month loan - that's nearly $1,800 in extra interest cost.

Thanks to Jonathan for sharing these real rates, you can follow him on Twitter or if you're in the market for a Honda and live near Pennsylvania, email him for a price quote.

Each week, I'll keep you up-to-date on the latest car deals and news that might affect your purchase. This includes...

- Best Rebates, Incentives, and Lease Deals

- Latest Car Buying Scams and Tricks

- The Best & Worst Time to Buy a Car

- Which Cars You Should Avoid

About The Author

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Gregg Fidan is the founder of RealCarTips. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate

the best car deals. He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.

Latest Weekly Car Buying Tips

February 2026

- Best Bang for Your Buck Lease Deals Feb 12, 2026

- Best Electric, Hybrid Lease Deals Feb 12, 2026

- Biggest Discounts on New Cars February 2026 Feb 12, 2026

- Real Prices of Large SUVs Feb 12, 2026

- Best 0% Finance Deals February 2026 Feb 05, 2026

- All SUV Lease Deals Compared February 2026 Feb 05, 2026

- Top 100 Cheapest New Cars Right Now Feb 05, 2026

- Real Prices of Midsize SUVs Feb 05, 2026

January 2026

- Best Car Deals by Category Jan 23, 2026

- Worst Cars to Lease Right Now Jan 23, 2026

- Real Prices of New Compact SUVs Jan 23, 2026

- Cheapest Luxury Lease Deals Jan 23, 2026

- Top 100 Cheapest Lease Deals Jan 15, 2026

- New Cars with the Most Available Inventory Jan 15, 2026

- Real Prices of Midsize Cars Jan 15, 2026

- Real Prices of Compact Cars Jan 09, 2026